Judging by the controversy, recent government measures aimed at accelerating the bank restructuring process (bankarization) and digital transformation of the national economy seem to be the clash of supporters and skeptics, while another not inconsiderable group of cautious people is waiting to see some results.

More forced by circumstances than by the usual evolution of the processes, Cuba has put its foot on the accelerator in a decision that should not surprise us too much considering that, as an unforgettable cartoon would say, with Cubans there are no manuals that count.

THE MEASURES AND THE REASONS

Resolution 111 of the Central Bank of Cuba at the beginning of August decreed that requests for cash in bank branches made by companies, private or state-owned, cooperatives and self-employed workers, generically known as economic actors, would be subject to limits according to "the conditions agreed with the bank and in correspondence with operational and fiscal levels". This step gave financial institutions much more decision-making power over how much cash they could or could not give to applicants.

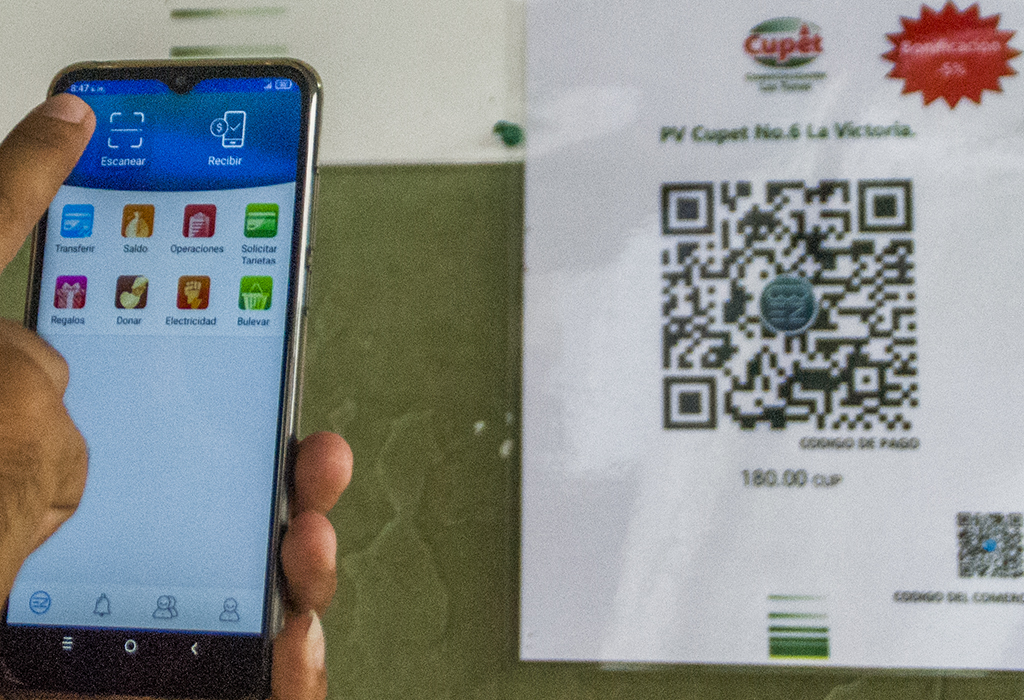

For the public, it was established that, from the very limited network of ATMs, only cash associated with pensions, salaries, savings accounts, and other personal assets would be allowed to be withdrawn. At the same time, it was indicated to public and non-public entities that, the following word is important, they should gradually create the conditions for the greatest possible number of payments for products or services to be made through existing payment gateways (Transfermóvil, EnZona, QR codes, as well as POS terminals). The aim is to accelerate two interlinked but not identical issues: the involvement of the financial system in commercial transactions and the wider use of electronic money transfers.

"Today the service of our branches is critical for several reasons, mainly because of the growing demand for cash against an income that does not support the work that each one has to do," admitted Alberto Quiñones Betancourt, vice-president of the Central Bank of Cuba (BCC in Spanish), days after the entry into force of "111". However, he stressed, that the regulation is not only a response to that but to the "need that our country has today for a more technologically advanced banking system."

Closer to home, Orlando Iglesias Carralero, director in Las Tunas of the Banco de Crédito y Comercio (BANDEC in Spanish), emphasizes that these measures will not mean the disappearance of cash because there will always be those who cannot bank their transactions or use digital tools to make them, he says. Moreover, he points out, that we are talking about an issue that was already among the priorities of the banking system in these parts.

Between June and July this year, says Iglesias Carralero, some 85 state or private entities requested direct debiting of their payrolls, a step towards paying their employees' salaries using magnetic cards. Moreover, of the 101 economic actors served by BANDEC, 70 percent have their bank accounts associated with magnetic cards and a similar percentage can access Virtual Bandec, the entity's portal for digital financial transactions. Between 2019 and July this year, he says, the number of magnetic cards associated with Bandec accounts in the Balcón del Oriente Cubano (Eastern Cuban Balcony) increased threefold, and the number of customers with multi-bank cards increased eightfold. In the same period, he adds, the total number of economic actors integrated into Virtual BANDEC doubled.

For its part, the Banco Popular de Ahorro (BPA in Spanish) in this territory, at least since March 2023, has had its banking penetration strategy, says its head, Nidia Rodríguez Vega. "A timetable was drawn up to see which payment center had the conditions, starting with the direct debiting of payrolls, particularly for retirees," she says. They also activated their links with the Post Office so that pensioners could be paid from their units. They also instructed facilitators on these issues."

Both managers, while noting that this is not the first time their institutions have had to deal with changes that alter their daily routines, agree that they now face a challenge in terms of staff training.

THE REACTIONS

Official data indicate that digital banking in Las Tunas has been gaining speed since August. In the first half of that month, the number of transactions carried out from state or private establishments with the QR code enabled exceeded five times! What was seen in the most successful months of last year in this aspect; the financial amount of those same transactions in a similar period experienced a growth of seven times! In addition, in the second week of the eighth month of this year, 16 small or medium-sized local private companies applied to enable their respective QR codes for 26 different businesses. It was also learned that 470 grocery stores in Las Tunas have already enabled both the QR code and the extra cash service (by Transfermóvil) or cash withdrawal (by EnZona).

These figures would indicate a positive response from those involved in the BCC Resolution, but before launching any alarm bells, it is worth noting that the financial amount referred to is still far from the total amount that moves, for example, in the establishments of Comercio Interior; this has been corroborated by previous investigations carried out by this newspaper.

The banks in Tunis confirm that, aside from the figures, caution prevails. They say, that although they extended their opening hours, they did not see an unusually high influx of representatives of legal entities in their branches after 3 August; nor did they notice a clear increase in their cash deposits. On the day before the announcement of Resolution 111, ATM withdrawals did rise, but 10 days later, they returned to the intensity seen in months such as July. Undoubtedly, the lack of cash and inflation have sown a distrust in people that leads them to continue making cash withdrawals above and beyond their immediate needs.

Of particular concern, they describe, are agricultural producers, often living in areas where telecommunications infrastructure makes it difficult to access digital payment platforms. "They have a differentiated focus," stresses bank managers, who promise that the more cash stocks grow in their branches, the more farmers will be the first to benefit from higher permitted withdrawal amounts than at present. They emphasize that they are listening to concerns and doubts to clarify any doubts.

Doris Navarro runs the medium-sized private company Real Navarro, which sells food and non-food products. She was no stranger to making payments through Transfermóvil or EnZona. However, she admits that she is going through an unprecedented transformation: "It is a change we have to adapt to," she says.

The biggest concerns, he says, are with his suppliers, who do not think it prudent to move all their transactions to the banking system and, by extension, to digital channels. And that, he fears, would affect available supplies. He also believes that a gradual process accompanied by a change in the mentality of the participants is vital.

In similar terms, Argel Frank Fundora Acosta, director of the medium-sized company Mercasa S.U.R.L., commented that it would be the importers who would suffer the most. His actions, however, testify to the fact that for him it is feasible to move forward with the digitization of their banking operations. Mercasa, he assured, will do so as soon as September 1.

Those who object to Resolution 111 criticize it for being preceded by mistaken actions such as the restriction of up to 120,000 pesos per month for transfers between natural persons. This, they reproached, took out of the banking environment operations of buying and selling foreign currency in the informal market; today the main forum in which private entrepreneurs and ordinary citizens obtain the freely convertible currency that finances, respectively, imports and the acquisition of products in high demand.

They predict that bank branches will be overwhelmed when those of small and medium-sized entrepreneurs join the current demands for services. They argue that the supply of private imports will be reduced, as these are mostly in cash, given the absence of a "banked" foreign exchange market. All this, they predict, will harm employment and the stability of many families. They believe that there will be an expansion of informal markets and a deepening of dollarization in them. Banking penetration, in their opinion, will put a cap on the circulation of cash in Cuban pesos, but it will not reduce the cash economy.

Of course, banking institutions maintain that regardless of the risks, this is a necessary step in the larger effort towards macroeconomic stabilization, while stressing in capital letters its gradual nature over the next nine months. However, they note that reaching a safe harbor will require an active role not only from the representatives of the financial system.

The most notable evidence has been that when governments and party leadership took action on the matter, several interesting situations surfaced: private companies that do not establish employment contracts with their employees to the detriment of their labor rights and the paradoxical delay of some state or political entities in direct debiting their payrolls, or in facilitating access to digital payment channels in their units providing services or selling products.

SEEING IS BELIEVING

Engaged in a kind of apostolate of trying to convince others of something they have not seen, but which they claim will be beneficial, the Banking System is right now in the eye of the hurricane. As with such atmospheric phenomena, the usual silence and restraint in its branches is surrounded by a whirlwind of opinions and situations that "heat" the atmosphere.

The success of Resolution 111 depends on addressing the causes that force economic actors and citizens to seek refuge in cash for their commercial transactions. The implementation of this regulation is taking place in a society with disparate skills and abilities in terms of the use of digital platforms, aggravated by the shortcomings of the telecommunications infrastructure.

All of this boils down to the fact that the cash transaction is still, in the eyes of those who make it, faster and more secure, whatever the latter term means to the individual.

We are talking about a digital transformation and bank restructuring that needs to focus on making it, in the eyes of those involved, part of the solution to their daily problems, based on experiencing its advantages, making the digital route a choice and not a path taken by decree. Only then will it cease to be a question of believing, but of seeing.